What is the total cost of this project?

$21,800,000

What is the total amount of bonded debt needed to support the project?

$20,400,000

Will this project increase my taxes?

Debt issued under this authorization will not raise the tax rate. Debt will be serviced by two main revenue sources: TIF District Financing and City Center Reserve Fund (see details on these sources below). There is no additional tax increase needed.

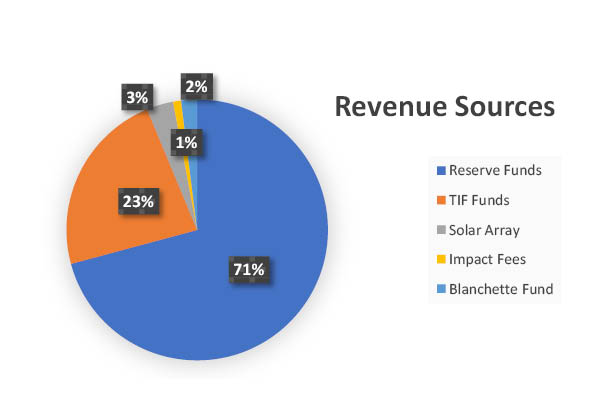

What are the sources of money that will pay for this project?

- City Center Reserve Fund ($15,400,000 Estimated Bond) 17-19 Years

- Tax Increment Financing ($5,000,000 Estimated Bond) 30 Years

- Library Blanchette Fund ($428,000)

- Impact Fees ($220,000)

- Solar Array RoofNet Metering Credits ($720,000)

Revenue Sources Further Defined:

City Center Reserve Fund

The City Center Reserve Fund is funded annually through the collection of taxes. Over the past 5 years, this fund has grown to an annual contribution of as much as $860,000. The current funding level for fiscal year 2019 is $750,000, and there is currently $3.4 million dollars in the fund. An annual payment from this fund of $736,000 is estimated to pay the debt on this project over 30 years. Because the current allocation of approved funding ($750,000) is larger than the payment required to pay the debt on this project ($736,000), no additional tax increase is required. The money that is not being used for this project will remain in the City Center Reserve Fund for future projects in City Center. Since the early conception of new public infrastructure in the proposed Downtown, the City Center Reserve Funds was planned and established to finance this type of project.

Tax Increment Financing

The TIF District Financing revenues are generated from new development within the TIF District – revenues that did not exist prior to 2012 and most of which would otherwise be transferred from South Burlington to the State. Tax Incremental Financing captures incremental additional tax income when projects are developed. These are taxes that otherwise would be sent to the State Education Fund. The revenue collected can then be invested in public infrastructure and facilities right here in South Burlington. We are already collecting TIF revenue and as additional private projects are developed, the amount will increase. Projects now contributing to the TIF include Trader Joes, Pier One, the Market Street condos, and Cathedral Square. TIF Funding for this project will contribute 30% of Library and Senior Center Funding, and 10% of City Hall Funding. The estimates for TIF Funding contributing to this project are based on current and approved projects. The City believes this is a conservative estimate. As additional private projects are developed, the TIF Funding will increase.

To view the spreadsheet for the estimated debt payment schedule, click the link below:

http://www.southburlingtonvt.gov/ECD/Projects/SoBu%20Spaces/Estimated%20Bond%20Payments%2009%2006%202018.pdf

For more information about TIF click the link below: http://www.southburlingtonvt.gov/residents/city_center_tif_district/tax_increment_financing_tif_101.php

Other Funding Sources

Additional funding sources include the Blanchette Fund (Library Bequest currently valued at $428,000), the Library Capital Fundraising Campaign, Impact Fees collected from development (estimated at $220,000), and net metering revenues for a solar array on the roof (estimated at $720,000).

Frequently Asked Questions

How long does the City have to incur debt through Tax Increment Financing?

There is a 5-year time period after the City first incurred Debt (February 2017) that ends

in March of 2022. Therefore, we’re a little over a year and a half into the TIF process, just under 3 ½ years left for the opportunity to incur any debt and utilize TIF to help offset costs on the projects that has been identified and approved by the City Council and the State VEPC Board for consideration of these funds. Most importantly, all TIF projects require the approval of voters, no TIF debt may be authorized without this.

What is the Capital Improvement Plan (CIP) for the City, and how does this relate to the City Center Reserve Fund?

The Capital Improvement Plan is a tool used to improve coordination in the timing of major projects, plan for capital replacement and major maintenance costs, and reduce large fluctuations in the tax rate. The City Center Reserve Fund is included as a part of the CIP. The Plan is not a budget, but provides a road map to guide budget preparation based on an estimate of future projects and costs consistent with City priorities and fiscal outlook. The CIP is prepared annually during the budget process and a summary of the 10-year CIP is included in the Annual Budget Booklet and can be found on the City webpage under the Finance Department-Budget.

Funds allocated to the City Center Reserve Fund are separate funds collected for this specific purpose, and not co-mingled with other capital improvement costs. The CIP is a part of the General Fund budget that is set aside each year for capital improvements. The planning for large ticket items, then, is spread out over time. The categories for CIP are itemized by department, for example- Fire, Police, Library, Public Works, Recreation & Parks, IT, etc.

Here is a link to the current CIP:

http://www.southburlingtonvt.gov/document_center/finance/FY19/Approved%20Capital%20Improvement%20Program%20FY%202019%20-2028.pdf

The City has been paying into the Capital Improvement Plan for the City Center project for 5 years. There will be no additional taxes, because the city has planned for this financing over time. Dollars allocated to the Reserve Fund can only be used for the Reserve Fund purposes, as defined in the Resolution approved by the City Council establishing the Reserve Fund.

Is the City Center Reserve Fund part of the General Fund Budget?

Any allocation to the City Center Reserve Fund is included in the General Fund (property tax monies for the operating budget). A transfer this fiscal year of $750,000 has been moved from the General Fund to the City Center Reserve Fund. There is currently $3.4 Million dollars in this Reserve Fund. The build-up of these funds will be used by the City to pay the initial higher payments that are over a million dollars annually while taxing at a much lower annual payment of debt at the $736,000 level. As this amount is below the annual transfer to the reserve fund, this project will not require an increase in the tax rate.

What is the current amount of City Debt from the General Fund?

It is important to distinguish here between what debt was incurred over time (original debt borrowed), and what is the balance of total debt. Currently the City has $18 Million dollars of debt balance,

$5 Million of which includes the two TIF projects already being funded for City Center- the reconstruction of Market Street, and the development of City Center Park. Both these projects will be completely funded by Tax Increment Financing, not necessitating any use of local tax dollars to fund these projects. Thus, the current tax rate reflects a General Fund obligation of bonded debt for just over $13 Million dollars. The majority of this debt is reflective of two major items, the Police Station- $4.3 million dollar balance, and the Pension Loan - currently with a $5.8 Million dollar balance. Current Debt by Fund is listed on the City website, Finance Dept.- Budget, and included in the Annual Budget Booklet. Enterprise Fund Debt for projects (water, sewer, stormwater) are paid by the rates collected for these services by the ratepayer, not paid for with tax money, thus these debts are not included in the General Fund budget, and not included in your tax rate.

What is the General Fund?

The General Fund is comprised of expenditures and revenues from a specific tax year that have been authorized by the voters as the official financial appropriation of funds for the operating budget. The difference between the expenses and revenues determines what the tax rate will be. To compute tax for an individual property owner, the City takes the property owner’s assessed property value, divides that by 100, and multiplies it by the actual property tax rate.